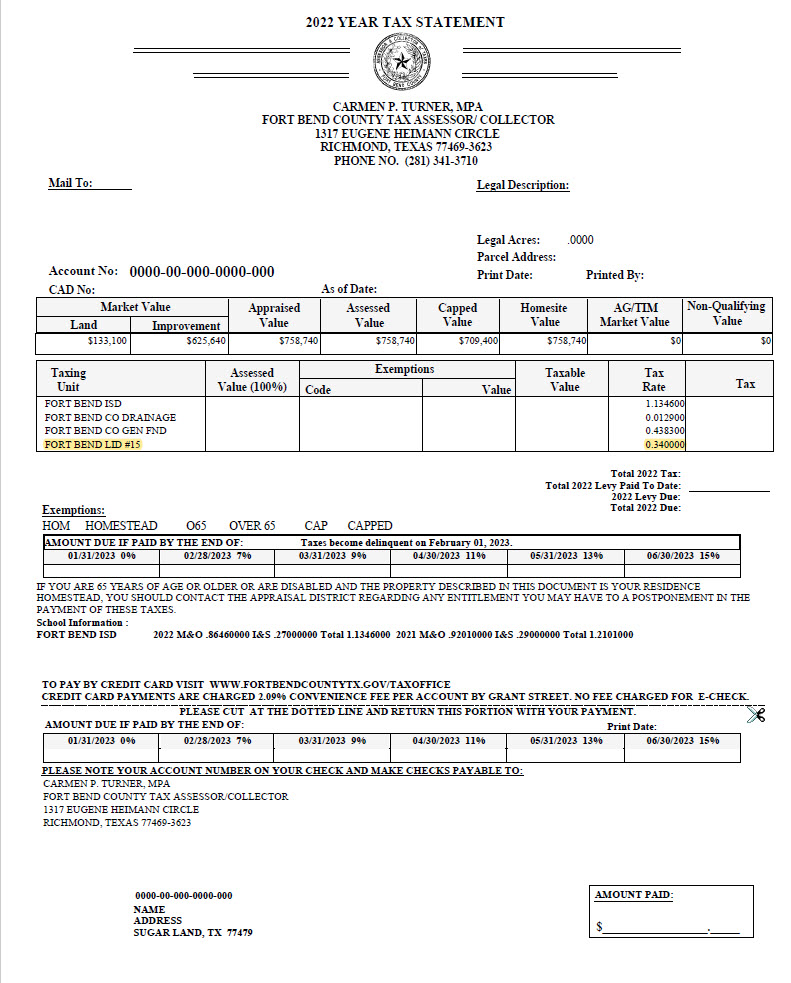

As a reminder, LID 15 taxpayers now receive a consolidated tax statement from the Fort Bend County Tax Assessor/Collector, and a sample is included below. Residents should not expect a separate LID 15 tax statement. The 2020 change to Fort Bend County tax collection is not only more convenient for residents, but it also reduces the District’s costs and saves your tax dollars.

The 2022 tax rate for LID 15 was reduced to $0.34 (per $100 of assessed value). This is $0.065, or 16%, less than the 2021 tax rate, and it will lower the average homeowner’s tax bill by $170. Over the past eight years LID 15 has reduced the total tax rate by more than 50%.