Tropical Storm Harold Update

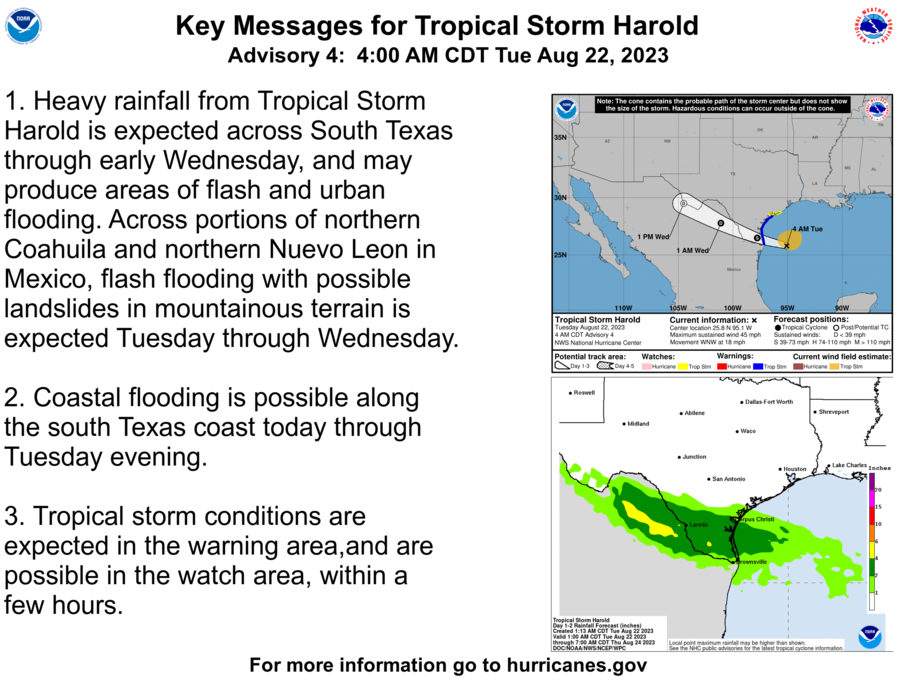

Fort Bend County Levee Improvement District No. 15 (LID 15) continues to actively monitor Tropical Storm Harold in the Gulf of Mexico. The probable path of Tropical Storm Harold does not include LID 15, and the District is currently forecasted to receive very little rain. The latest forecast and information from the National Weather Service is included below (https://www.nhc.noaa.gov/graphics_at4.shtml?start#contents ). The Brazos River is also at low levels that do not impact drainage inside the LID 15 levee.

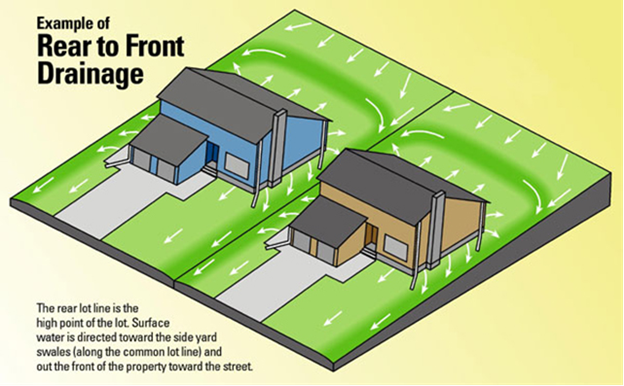

The LID 15 pump stations and portable pumps are exercised monthly, and operators are always available to run the pumps, if needed. During any heavy rain event there may be street ponding or flooding if the storm drains are overwhelmed and back up. As rainfall decreases, the storm sewers will catch up, and any water in the streets will recede. Never drive into high water.